Tracking your loans

A loan is money you borrow and must pay back with interest.

If you decide to take out a loan, make sure you understand who is making the loan and the terms and conditions of the loan. Student loans can come from the federal government or from private sources such as a bank or financial institution. Loans made by the federal government, called federal student loans, usually offer borrowers lower interest rates and have more flexible repayment options than loans from banks or other private sources. Learn more about differences between federal and private student loans.

Understanding the repayment process for your federal student loans can go a long way toward building a solid financial foundation.

Remember, federal student loans are real loans, just like car loans or mortgages. You must repay a student loan even if your financial circumstances become difficult. Your student loans cannot be cancelled because you didn’t get the education or job you expected, or because you didn’t complete your education (unless you couldn’t complete your education because your school closed). Under certain circumstances, you can receive a deferment or forbearance that allows you to temporarily postpone or reduce your federal student loan payments. Postponing or reducing your payments may help you avoid default.

You can track your loans in CheckMarq using the steps described below.

- Find your Loan Information

Log in to CheckMarq, click or tap the Financial Aid tile and select View Loan Debt from the menu.

- Review your loan history and repayment options

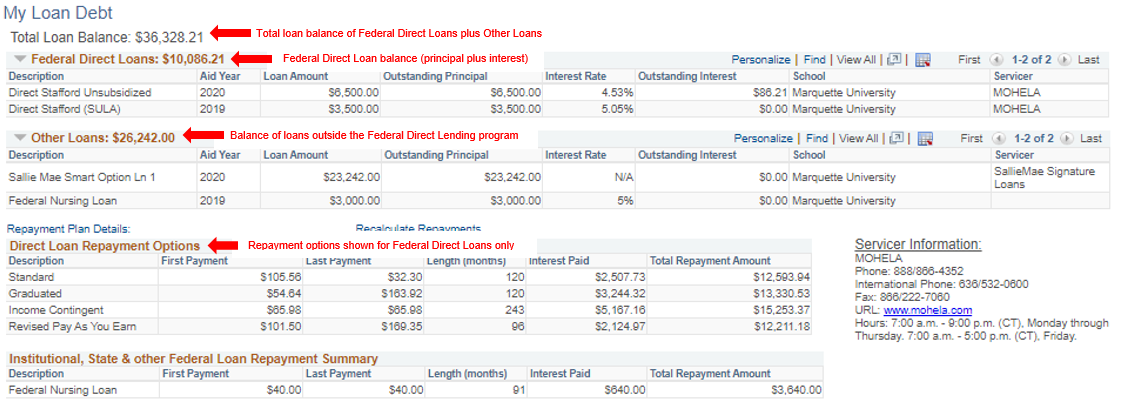

The 'My Loan Debt' screen shows your loan history, Federal Direct Loan repayment option and loan servicer(s). These numbers are estimates. To receive the most up-to-date balance information, including interest and payments, please contact your servicer(s) or visit studentaid.gov/manage-loans. Estimates may have been used when determining interest rates and repayment plans.

- Repayment Details

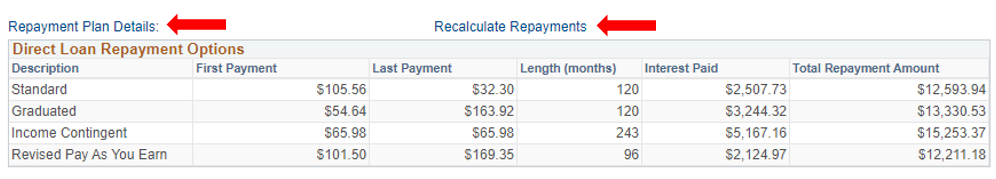

Review additional details on payment plans and use the calculator to personalize payments. More detailed information on repayment options and calculations are available on studentaid.gov/manage-loans.

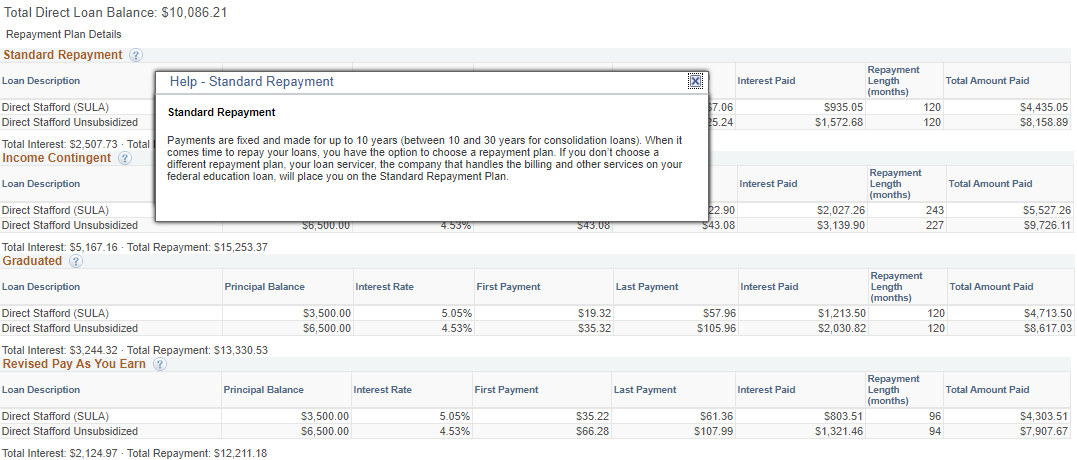

Repayment Plan Details will break down each repayment plan. This screen shows how much money is being paid toward each loan in the Federal Direct Loan program, how long the repayment will take, and how much interest will be paid on each loan. You can click or tap the ? to display information regarding each repayment plan, such as how you qualify and repayment terms.

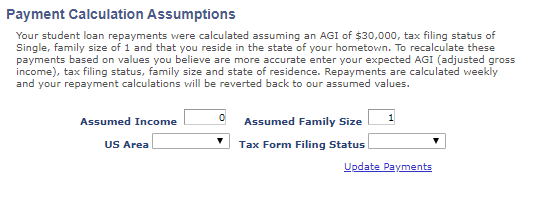

Recalculate Repayments lets you update your earnings and family situation to get a more personalized estimate of your repayment amounts under the different payment plans. Enter the information and click or tap Update Payments to see the changes.

PROBLEM WITH THIS WEBPAGE?

Report an accessibility problem

To report another problem, please contact marquettecentral@marquette.edu