The next steps you take depend on which loans you are taking. New direct loan borrowers will need to complete Entrance Counseling and a Master Promissory Note. Optional loan borrowers will need to complete the application process specific to the loan they are applying for.

MASTER PROMISSORY NOTE & ENTRANCE COUNSELING

- Required for all first time Direct Loan borrowers.

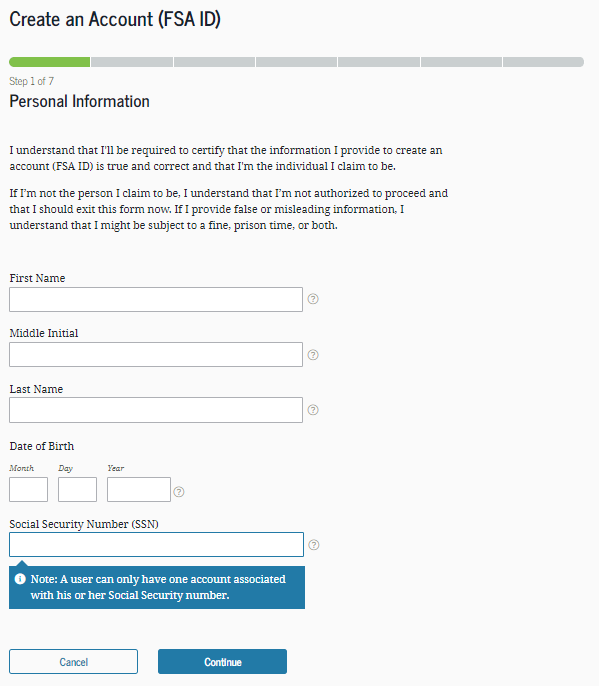

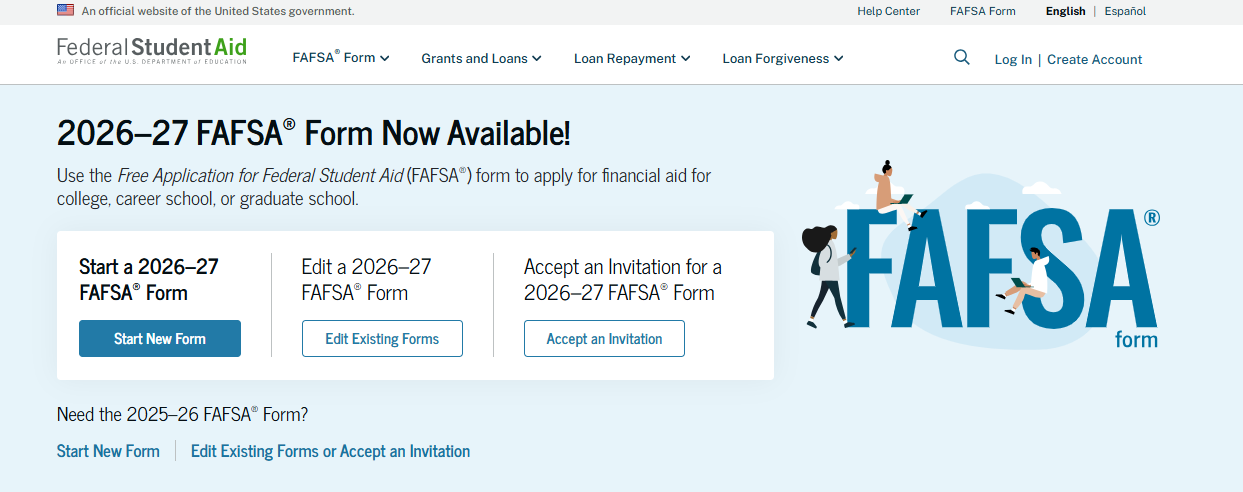

If you are a first-time borrower at Marquette and have accepted your Federal Direct Loan(s) in CheckMarq, you will need to sign an electronic Master Promissory Note (MPN) and complete Entrance Counseling online. After receiving notification via Marquette Email that the MPN is available, visit studentaid.gov/mpn and log in with your FSA ID.

-

While enrolled at Marquette, you need to sign the subsidized/unsubsidized MPN only once.

-

For additional information about Entrance Counseling visit mu.edu/central/dlentrance.

OPTIONAL LOANS

The OPTIONAL loan (Parent-Student) cannot be accepted in CheckMarq. An optional loan can either be a Parent PLUS loan or a Private/Alternative loan. The amount listed on the financial aid award is the maximum that can be applied for; a lesser amount may be requested. To apply for an optional loan complete the following steps.

FEDERAL DIRECT PARENT PLUS LOAN

- For the parent of a dependent student wanting to take a loan to assist the student in paying educational expenses.

- Parents can apply for the Parent PLUS loan beginning in mid-May for the upcoming school year.

Follow these steps to apply for a Parent PLUS loan:

-

Beginning in mid-May visit studentaid.gov/plusapp. (Do not use studentloans.com, this is a commercial website.) The parent must submit an application for each new loan.

-

Sign in using the parent’s FSA ID and select "Start" next to “Direct PLUS Loan Application for Parents.” Do not use the student’s FSA ID to sign in.

-

Follow the steps to complete the application and credit check. In the School Name section, be sure to select Marquette University.

-

The results of the parent’s credit check will be available immediately. If the credit is approved, the parent borrower will be given instructions for completing a PLUS Loan Master Promissory Note. If credit is not approved, the parent will have the option to obtain an endorser, appeal the credit decision, or not pursue the loan.

The parent borrower who applies for the Parent PLUS loan must sign the Parent PLUS MPN.

A parent borrower needs to sign his or her MPN only once for each student enrolled at Marquette, unless the loan is approved through an appeal or endorser.

-

If the parent or the student is an eligible non-U.S. citizen, you may also be asked to submit a copy of your U.S. Citizenship and Immigration Services document to Marquette Central to verify your citizenship status.

PRIVATE ALTERNATIVE LOAN

To apply for a private alternative loan, a student must apply directly with a lending institution. Visit mu.edu/central/altloans for more information. Alternative loans are non-federal educational loans available from a variety of lending institutions. The borrower needs to have a satisfactory credit history and, in most cases, a creditworthy co-signer.