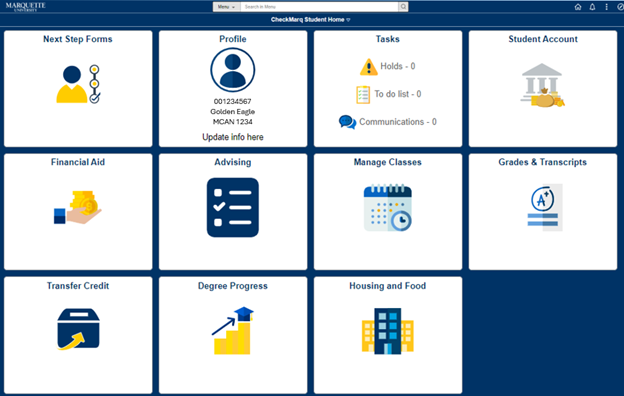

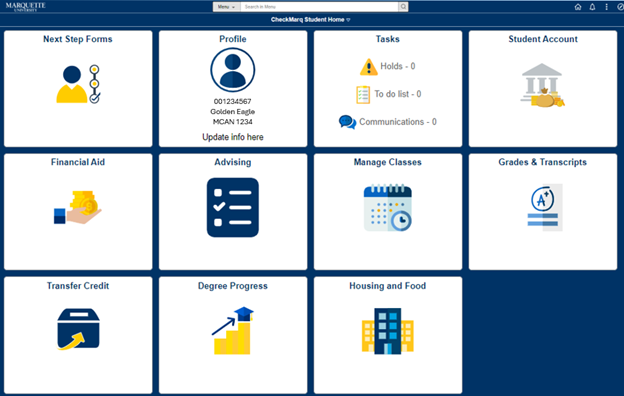

CheckMarq is a gateway to student information at Marquette University. It allows students to check financial information, register for classes, request transcripts, view grades, check registration appointment times and plan future terms. Navigation is tile based where key pages are grouped together for ease of use.

For more information on CheckMarq visit our Student CheckMarq page.

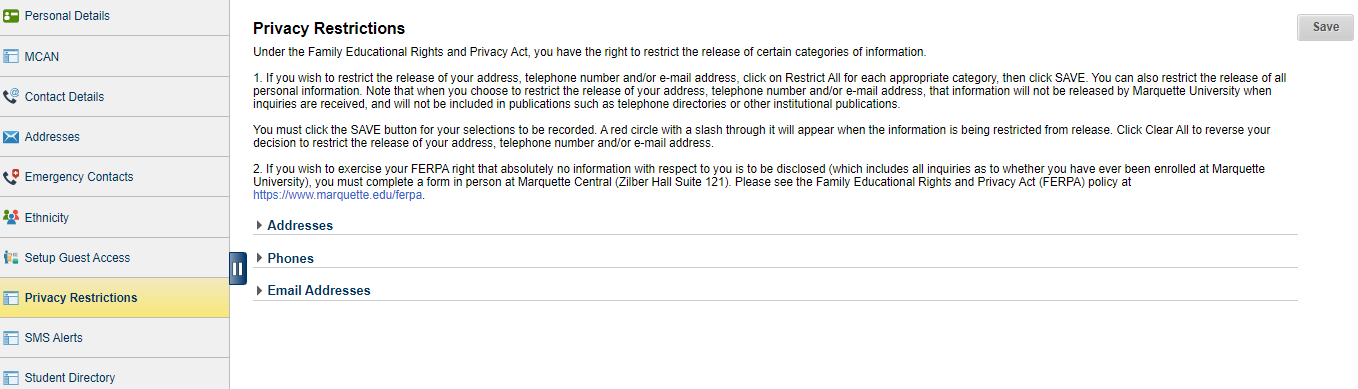

Family Educational Rights and Privacy Act (FERPA)

This federal law protects the privacy of student records at Marquette. Once enrolled in a class, no one may access student records without the student’s permission, except:

- The student.

- University personnel who require the information for legitimate educational purposes.

- The university when required by law or contractual obligation to do so.

To learn more, visit the Office of the Registrar.

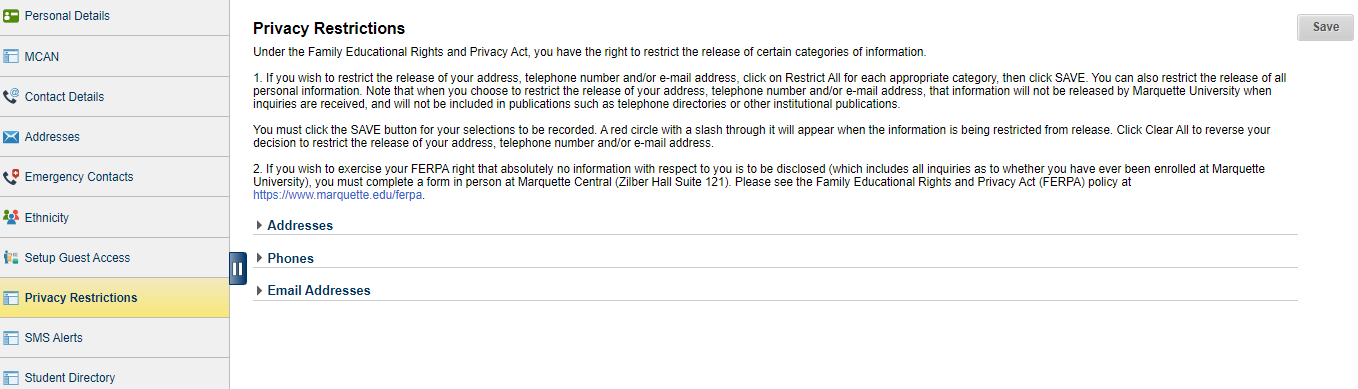

Students can update their FERPA Restrictions by visiting CheckMarq Student Home > Profile > Privacy Restrictions. If students choose to restrict their address, telephone number and/or e-mail address, that information will not be released by Marquette University when inquiries are received, and will not be included in publications such as telephone directories or other institutional publications.

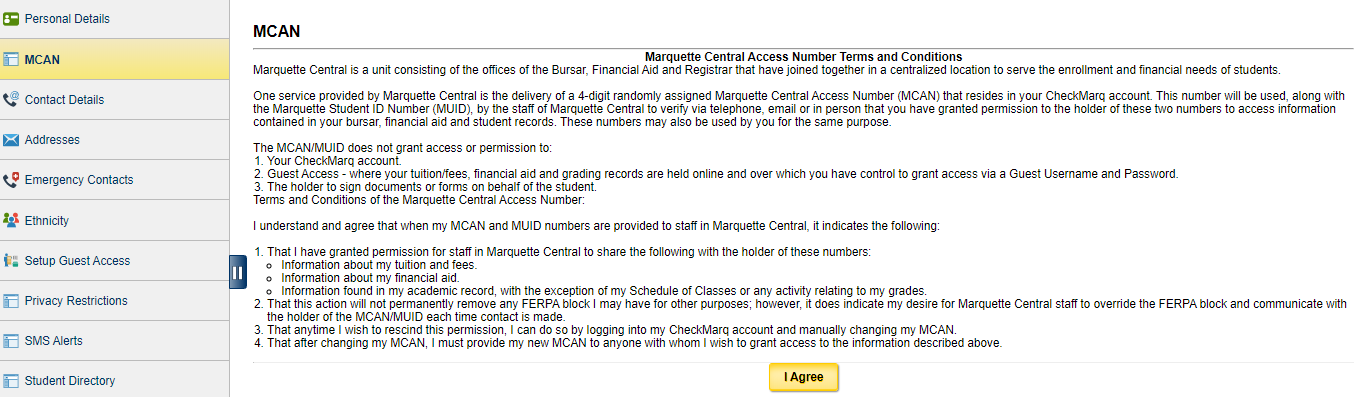

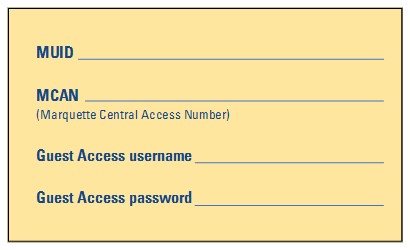

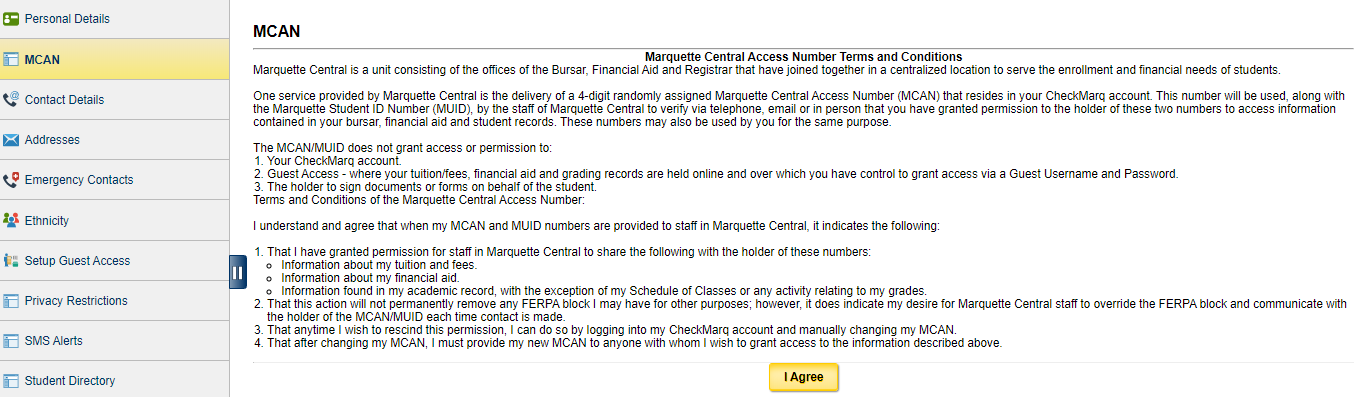

Marquette Central Access Number (MCAN)

To follow FERPA, students and their families must verify their identity when contacting Marquette Central.

The MCAN is a randomly generated four-digit number used with the nine-digit Marquette ID (MUID) number to help Marquette Central staff identify people authorized to access student information. The MCAN and MUID are needed when contacting Marquette Central via phone or in person.

Students can find the MCAN by visiting CheckMarq Student Home > Profile > MCAN.

(The MCAN is NOT available via online Guest Access.)

A student may authorize others to receive their student financial and record information (excluding grades and schedules) by providing them with the MCAN and the MUID.

The MCAN can be changed by students in CheckMarq at any time.

Students should be careful when disclosing their MCAN and/or MUID numbers to help protect their personal information.

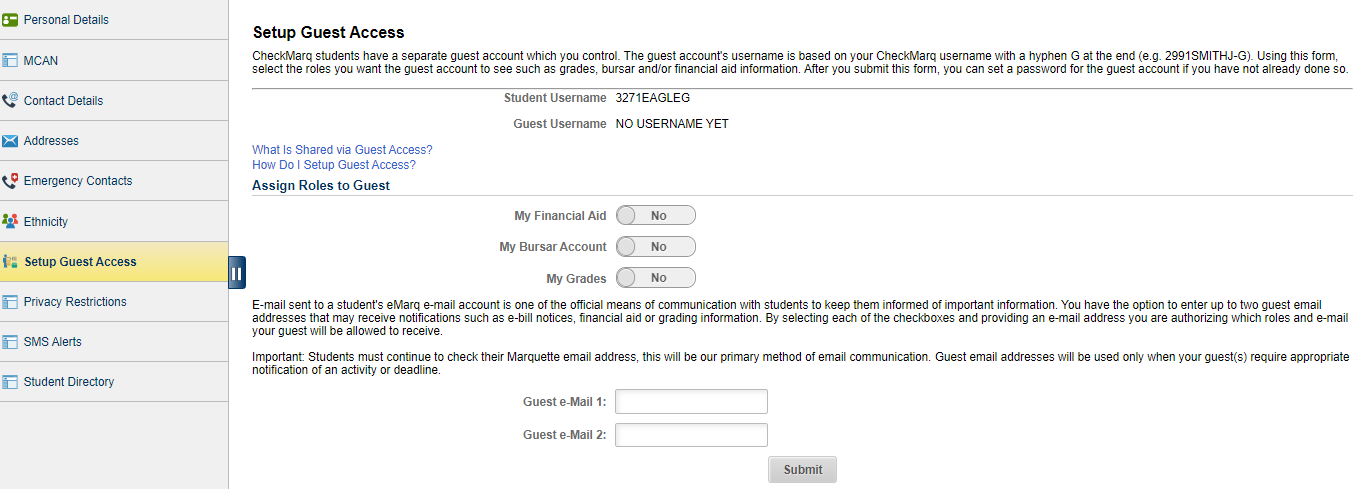

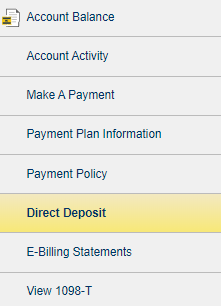

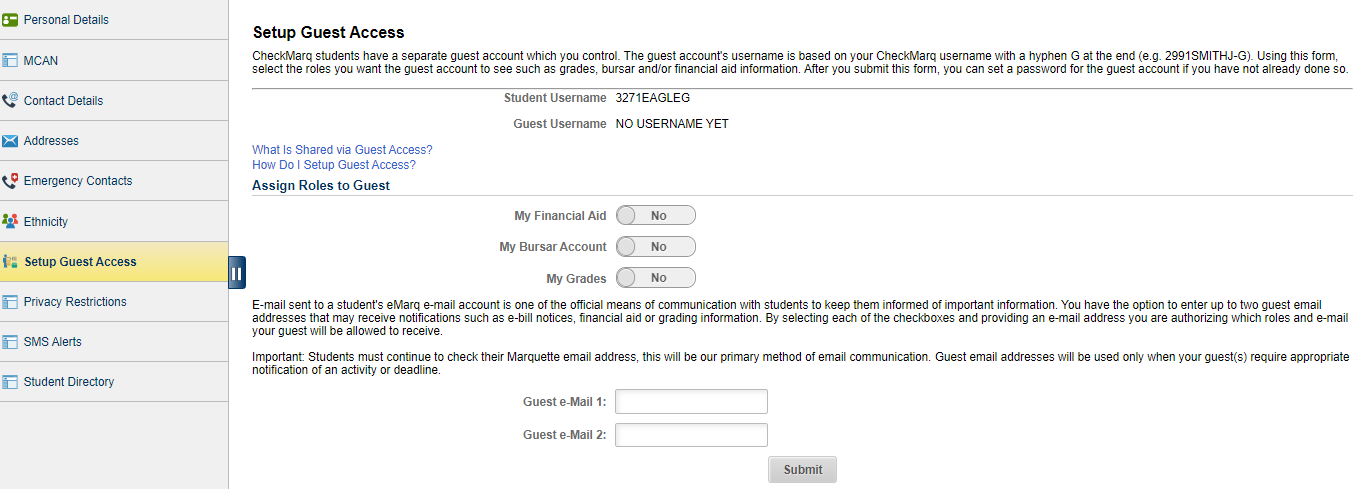

Guest Access

CheckMarq provides Guest Access so others can view grades, student account and/or financial aid information and make payments. With the guest username and password, those selected by the student, such as parents, guardians or spouses, can check the student’s account information.

To grant access, visit CheckMarq Student Home > Profile > Setup Guest Access

If a guest email address is entered, the guest will receive e-bill notifications.

Students can end Guest Access or change information that guests can view at any time.

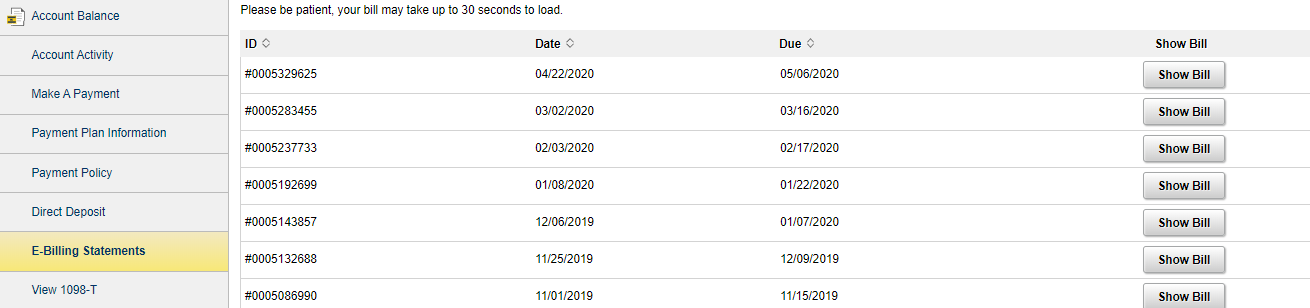

Student account access allows guests to view the tuition balance, e-bill, 1098-Ts and links to pay via credit card or e-payment.

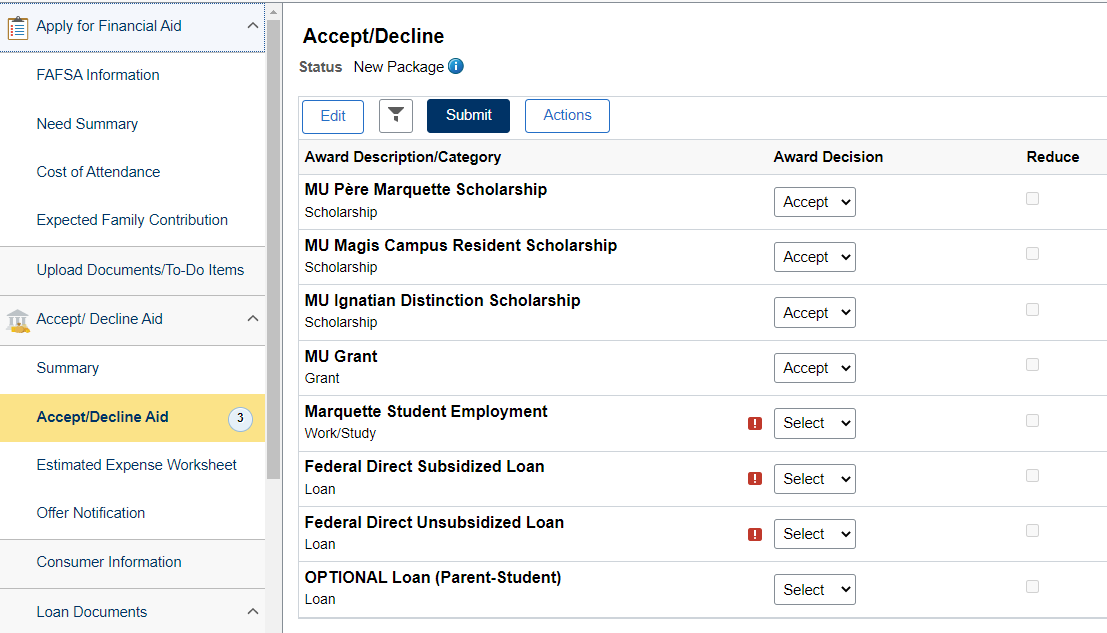

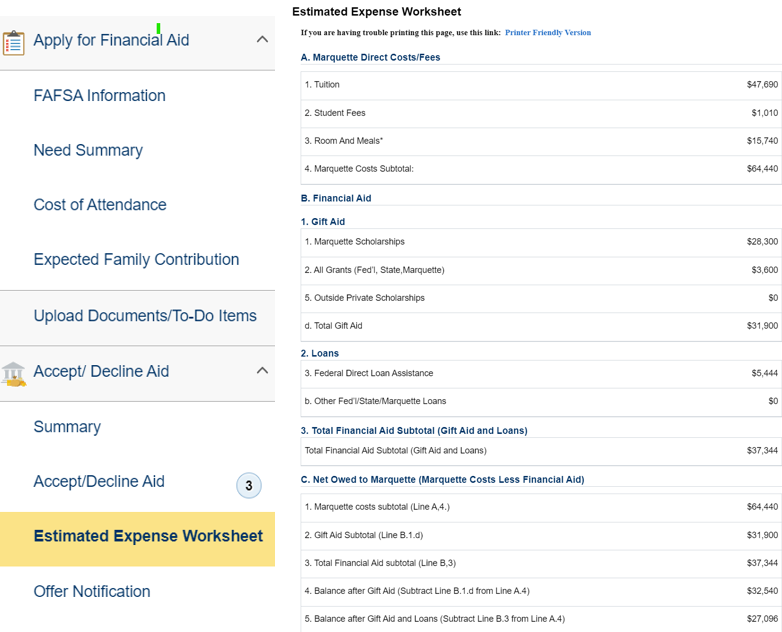

Financial aid access allows guests to view offered and accepted aid, along with the expense worksheet. Guests cannot accept or decline financial aid.

Grade Access allows guests to view midterm and final grades.